Saudi healthcare market needs $37.3b investment

The healthcare market in Saudi Arabia requires an estimated $23.6 billion – $37.3 billion new investment as the population grows at a rate of 2.65% per annum, said Colliers International, the global commercial real estate leader, in its latest white paper on the healthcare sector in the Kingdom.

The report, which is the 8th edition in their series of research papers on healthcare in the MENA region, revealed that based on historical population growth rate of 2.65% per annum, by 2030, KSA will require an additional 50,000 new beds (with current ratio of 2.23 beds per 1,000 population) and over 110,000 bed (with world average of 2.7 beds per 1,000 population) and almost 40,000 more doctors.

Mansoor Ahmed, Director of Healthcare, Education and Public Private Partnerships (PPP), said “one way of bridging the required investment is by creating more REIT funds. We estimate that REIT funds in the Kingdom can unlock around $7.5 billion to $8.5 billion property value from the private sector, thereby playing a major role in extending the growth in the healthcare sector. In addition to the above, with the foreign investors ownership announcement by the Saudi Arabian General Investment Authority (SAGIA), in which foreign investors can have 100% ownership in healthcare and education sectors, which once implemented, is expected to boost private sector investment in the healthcare sector.”

He noted that the healthcare sector in Saudi Arabia is undergoing evolution on the back of rapid advancements in technology, research and development (R&D) in line with the global and regional trends. However, healthcare providers and professionals are grappling with several challenges concurrently, such as patients becoming customers and the patient care transitioning from “fee for quality” rather than “fee for service”. This coupled with new compliance requirements that aim at wellness and prevention plus ensuring better coordination, efficiencies, add depth and complexity to an increasingly competitive marketplace.

Recent trends and industry dynamics require operators in the healthcare sector to make challenging decisions. While the healthcare system has improved across the region including Saudi Arabia, the sector offers opportunities for investors/

operators, the report further said.

Key factors that make Saudi Arabia’s healthcare market attractive are:

• KSA’s healthcare sector is structured to provide a basic platform of healthcare services to all, with specialized treatment facilities offered at some private and public hospitals.

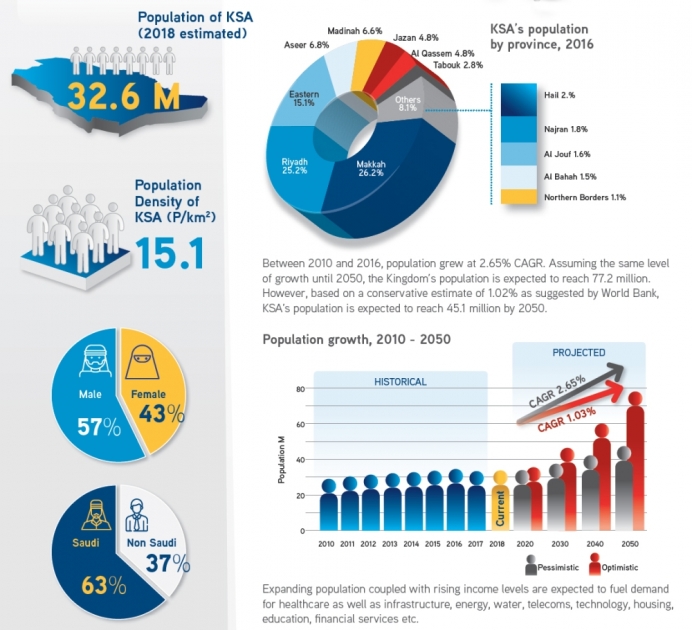

• KSA has an estimated population of 32.6 million in 2018, which is expected to double, reaching 77.2 million by 2050, growing at 2.65% per annum. Assuming a more conservative 1.02% average annual growth, as suggested by World bank, KSA population would still reach 45.1 million by 2050. This increase in population is expected to fuel the demand for healthcare services in the kingdom. Concurrently, the

healthcare system needs to treat emerging Lifestyle Diseases and Illnesses associated with modern and urban lifestyle, partially due to the growing middle-income population.

• The government is encouraging private sector participation in the healthcare sector as the public sector’s role is gradually transitioned to becoming more of a regulator rather than as a provider of healthcare facilities, as highlighted in the National

Transformation Plan (NTP) and the privatization plan. In 2017, Saudi Arabian General Investment Authority (SAGIA) announced that foreign investors can have 100% ownership in health and education sectors, once implemented this is expected to boost private sector investment in healthcare in KSA.

• Government commitment to healthcare is evident as the government continues its efforts in developing various medical cities, however, many of these facilities are expected to be operated in conjunction with the private sector investment using various Public Private Partnership (PPP) models.

• The healthcare and social services sector has been allocated 15% (SR147 million) of the total KSA’s 2018 budgeted expenditures, up from actual spend of SR 133 million during 2017. This 10.5% increase in the allocation reflects a strong indication of potential demand as well as the government’s willingness to augment growth and improvement within the sector.

Moreover, the report said the population pyramid in KSA has significantly changed between 1980 and 2015, and it will further change by 2050 this will have a significant impact on healthcare demand in terms of quality, quantity and type of healthcare facilities.

During 2015-2050 approximately 19 million babies will be born in KSA, creating demand for facilities and services, relating to mother and childcare (obstetrics, gynecology, pediatrics, etc.) along with the more common prevailing communicable and some non-communicable diseases.

The age group between 20-39 years is very important for future healthcare planning, as it is common that there is the development of chronic diseases; cardiovascular, irritable bowel syndrome, chronic obstructive pulmonary disease and some types of cancer.

These have a long-term impact on demand for healthcare. With 12 million population in this age group there is considerable demand not only for curative but also preventative facilities.

“Over the next three decades, we envisage a sharp rise in healthcare demand as approximately 80.0% of an individual healthcare requirements typically occur post the 40-50 age range. This is primarily due to an increase in lifestyle related diseases, such as diabetes, coronary and other obesity-related illnesses,” the report forecast.

Besides, `n increase in life expectancy in KSA is expected to extend from the current level of 73.1 years and 76.1 years for males and females respectively to 78.4 and 81.3 by 2050.

This is expected to create demand on long- term care (LTC) facilities, focusing on geriatric related care, rehabilitation and home healthcare services.

Based on current international benchmarks of 4-6 beds per 1,000 population above 65 years, Saudi Arabia currently needs from 6,400 to 9,600 beds dedicated for LTC, this is expected to reach 41,200 – 61,800 LTC beds by 2050, the report added.