Value of contract awards to plummet in 2016

The value of contracts awarded in the GCC is set to drop sharply by 15 per cent in 2016 as low oil prices hit government spending plans, according to the latest forecast by MEED Projects, the region’s leading project tracking service.

The forecast, which is based on more than 2,100 planned and un-awarded projects in the region, predicts that the total value of contracts will fall to $140bn this year, compared with $165bn for the whole of 2015.

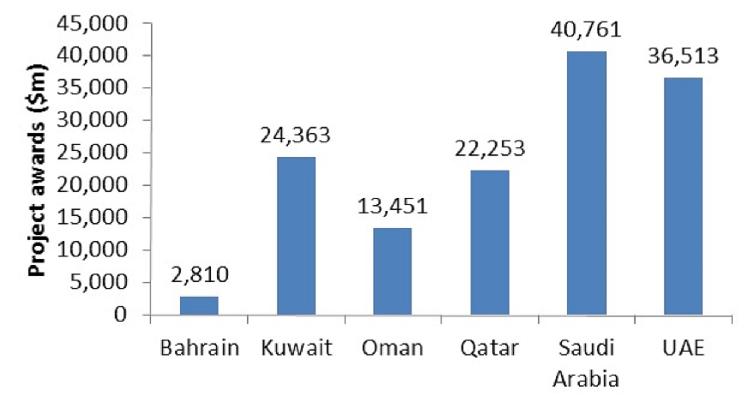

Worst hit will be Saudi Arabia, which is forecast to drop by almost a fifth, equal to nearly $10bn, to $40.7bn in 2016. The kingdom has seen its revenues fall in line with the oil price, and in its 2016 budget says that forecast revenues will be SR513bn ($137bn), almost SR100bn lower than last year. At the same time, budgeted spending of SR840bn will be far below the estimated SR975bn expenditure of 2015.

The UAE, buoyed by continuing spending in the Dubai real estate and infrastructure sectors and long-term strategic spending in the Abu Dhabi oil and gas sector, is forecast to see contract awards fall slightly to $36.5bn from $37.4bn. Dubai’s commitment to its long-term vision will ensure that spending on projects is maintained despite the worsening financial situation.

The third largest projects market in the GCC will be Kuwait at $24.3bn, down from a record high $31.5bn in 2015. It will be followed by Qatar, which will see contract awards fall by $7bn to $22.2bn. While the two markets will perform worse than last year, their 2016 forecast is still considerably improved on their five-year spending average.

Oman and Bahrain are anticipated to maintain last year’s spending levels, recording $13.5bn and $2.8bn respectively, although their comparatively small sizes mean that this will have a relatively small impact across the region as a whole.

“With oil prices hitting 11-year lows, there is no real surprise that project spending is forecast to fall in 2016,” says Ed James, Director of Content and Analysis at MEED Projects. “However, it does mean that it will be a tough 12 months for companies in the sector as the number of project opportunities is reduced.”

As a result of falling revenues, governments are expected to prioritise public-private-partnership (PPP) projects and schemes that use other forms of funding, such as export credit agency and contractor financing. “Firms that can bring their own financing to projects will be in a much stronger position to negotiate with clients because it enables them to keep spending off balance sheet,” says James.

There are some positive drivers, however. Spending on power and water projects as well as social infrastructure investment, will be stable in order to maintain economic diversification and job creation efforts. “Governments frankly have little choice, to keep building affordable housing, schools, hospitals and power plants if they are to maintain the social compact,” says James. “For example, faced with a choice between building a new power plant or having electricity blackouts, governments have little option but to invest in the facility.”

At the beginning of 2015, MEED Projects forecast total contract awards of more than $172bn for the year, compared with the actual final total of $165bn. While Kuwait, Oman and Qatar performed broadly as expected, the UAE and Saudi Arabia were substantially lower than forecast. “The biggest underperformer last year was Saudi Arabia,” says James. “The announced hiatus on contract awards in Q4, plus the postponing of several key projects such as Saudi Arabia’s stadium programme and the Mecca metro scheme, resulted in a shortfall of nearly $10bn. In the UAE, the principal cause of the federation’s underperformances was the Abu Dhabi market. While oil and gas spending there has remained robust, investment in the civil construction sector has been relatively anemic compared with previous years”.